Phi’s D2C Payment Gateway Precision-built. Lightning-fast. Made for the next-generation D2C shopper

Higher approvals, seamless affordability, and prepaid boosters, built for fast-growing D2C brands.

Losing revenue to payment failures, high COD,

and poor checkout conversion?

Most D2C brands in India lose 30–40% of their potential revenue at checkout. Payment failures, OTP drops, low EMI/BNPL adoption and high COD share hurt conversions and most providers cannot fix this.

As volumes grow, the cracks get bigger:

OTP failures rise

AOV plateaus

COD/RTO eats margins

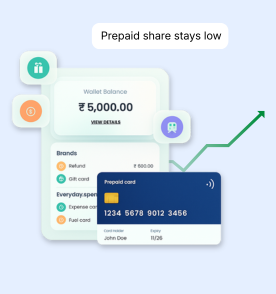

Prepaid share stays low

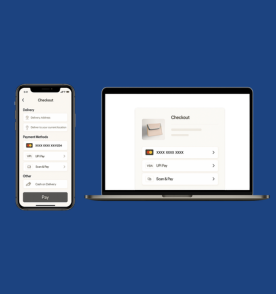

Checkout UX is inconsistent across devices

Phi gives D2C brands a conversion-first payment stack, so you earn more from every customer who reaches checkout.

Higher approvals, frictionless affordability, and prepaid recovery tools come built into your payment flow.

Turn More Shoppers into Paying Customers

Higher Approval Rates

Increase Prepaid Share

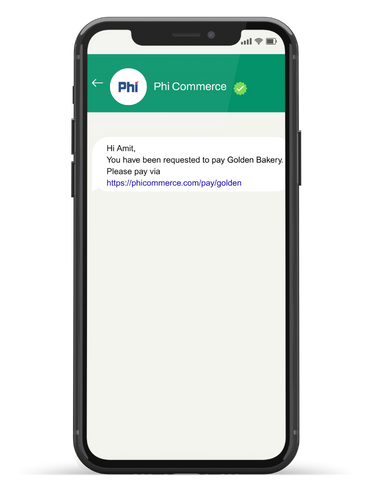

Payment Links + WhatsApp Commerce turn COD orders into prepaid.

Lower RTO, better margins, and smoother cash flow.

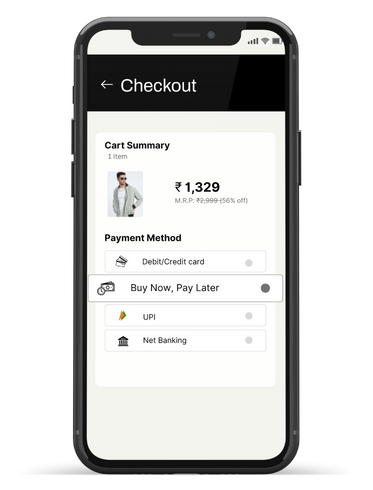

Full EMI & BNPL Affordability

No-cost EMI, low-cost EMI, BNPL, and bank offers built directly into checkout.

Increase AOV and give customers more reasons to complete the purchase.

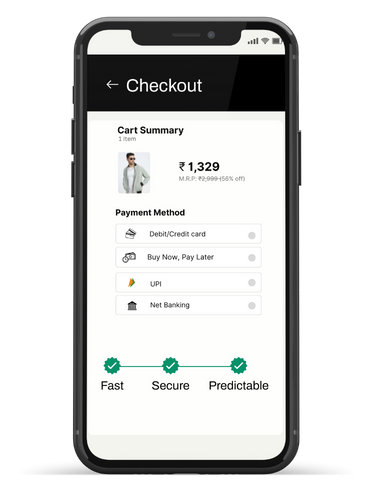

Enterprise-Grade Reliability

High uptime, fast routing, tokenization, and stable performance even during spikes.

Your D2C checkout stays fast, secure, and predictable.

Hear from

our Clients

What You Gain Fast

More Paying Customers

Fewer drop-offs, more successful payments

Better Margins & Lower Risk

Less COD, fewer returns, smoother cash flow

Higher AOV & Conversion Rates

Frictionless Checkout Experience

Quick Integration

Join these Companies that Count on Our Expertise

Scale and Reliability That Enterprise Brands Depend On

- 5,000,000+ daily transactions processed

- High-performance switching powering 1300+ banks & issuers

- Enterprise-grade uptime

- Trusted across large-scale BFSI and government platforms

Key Features

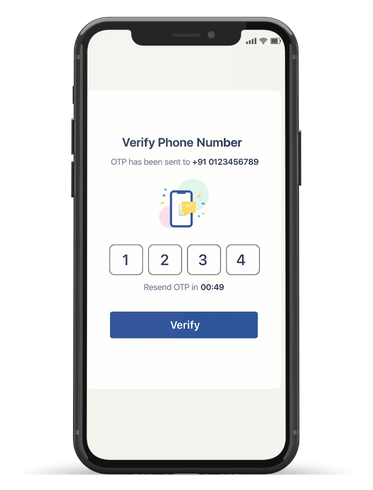

Native OTP

Reduce OTP failures by up to 30% and instantly boost approval rates.

EMI & BNPL

Increase AOV and affordability adoption with no-cost EMI, low-cost EMI, BNPL, and issuer-wide bank offers.

Offer Engine

Run instant discounts, bank offers, and brand promotions without developer intervention.

Payment Links

Convert COD prepaid with one-click links sent via SMS, WhatsApp, and email.

WhatsApp Commerce

Recover abandoned carts and enable conversational checkout inside WhatsApp.

Pre-Authorization

Reduce RTO and manage high-ticket orders with seamless pre-auth flows.

Insights & Dashboards

Understand declines, approvals, and affordability performance at a granular level.

Ready to increase your D2C conversions?

Frequently Asked Questions

How does Phi improve checkout conversion rates?

Phi increases conversions with native OTP, faster routing, and affordability options that reduce drop-offs.

How can D2C brands increase payment success or approval rates?

We improve payment success rates by reducing OTP failures and using optimized acquiring for 3–7% higher approvals.

Why do online payments fail and how does Phi fix it?

Most failures come from OTP delays and issuer timeouts. Phi fixes this using native OTP + smart routing.

Does offering EMI or BNPL improve sales?

Yes, EMI/BNPL increases AOV and prepaid orders. Phi activates them directly inside checkout.

Can Phi help reduce COD orders?

Yes, Payment Links + WhatsApp checkout convert COD customers to prepaid.

How fast can we go live with Phi?

Most D2C brands go live in 24–48 hours via Shopify/WooCommerce, and 2–5 days for custom sites.

Does Phi support UPI, cards, EMI, and BNPL?

Yes, Phi supports UPI, cards, netbanking, EMI, BNPL, wallets, and bank offers.

Is Phi secure and compliant?

Absolutely, Phi uses banking-grade infrastructure and is PCI-DSS certified.