Introduction

India’s D2C ecommerce market is growing fast. It is expected to reach USD 267 billion by 2030, growing at over 25% annually. But behind this growth lies a serious problem. Enterprise D2C brands are spending more money to grow, yet earning less per order.

The reason is simple. Discounts no longer work at scale. Heavy discounting has increased customer acquisition costs, hurt margins, and weakened brand value. For large D2C brands, especially in premium categories, this model is no longer sustainable. That is why many enterprise brands are shifting focus from price cuts to payment flexibility. One strategy is standing out clearly: EMI.

EMI allows brands to grow Average Order Value (AOV) without reducing prices. It changes how customers think about affordability and delivers better long-term outcomes.

The AOV Challenge Facing Enterprise D2C Brands in India

Why Discounts Stop Working at Scale

- Margin erosion becomes inevitable: When a ₹25,000 product is sold at a 30% discount, the brand immediately loses ₹7,500 in revenue. Payment fees, logistics costs, packaging, and returns remain unchanged. Over time, margins shrink from healthy 50%+ levels to 40–45% or lower.

- Brand dilution sets in: Customers get trained to wait for sales. The product loses its premium perception. Over time, the brand competes only on price, not value.

- Short-term spikes hide long-term decline: Discount campaigns often show impressive revenue jumps. But contribution margins drop sharply. Growth looks good on dashboards, while unit economics quietly collapse.

Why Premium D2C Categories Feel This Pressure More

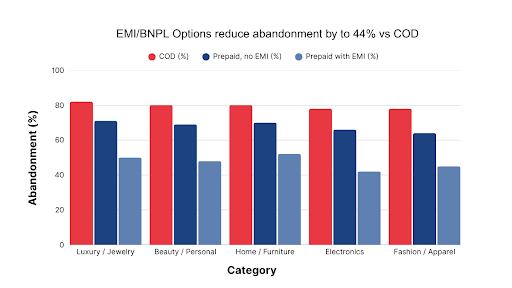

- Cart abandonment is extremely high: Premium categories see abandonment rates between 78% and 83%, even during sale periods.

- Discounts hurt these categories the most: A 20% discount on a ₹50,000 product wipes out ₹10,000 instantly. Fixed costs remain the same. If the order is COD and returns, the loss multiplies.

- Repeat customers matter more, but discounts attract the wrong ones: Repeat buyers contribute over 40% of total revenue, yet represent less than 10% of customers. Discount-driven buyers repeat far less often than EMI-enabled buyers.

For premium brands, discounts trade long-term value for short-term volume.

EMI as a Strategic Growth Lever (Not Just a Payment Option)

How EMI Changes Consumer Buying Behaviour

EMI works because it changes the mental calculation customers make. Instead of asking, “Can I afford ₹50,000 right now?”, customers ask, “Can I afford ₹4,166 per month?”

- Monthly affordability feels manageable – Large one-time payments feel like a loss. Monthly payments feel planned and controlled. This is why subscriptions and instalments are growing rapidly in India.

- EMI expands the addressable market – A customer who cannot pay ₹45,000 upfront may comfortably commit to ₹3,750 per month. EMI makes premium products accessible without lowering prices.

- Data shows that purchase likelihood increases from 17% to 26% when EMI or BNPL options are shown. For metro customers buying premium products, adoption is even higher.

EMI vs Discounts: A Side-by-Side Business Impact View

| Metric | Discount-Driven Growth | EMI-Led Growth |

|---|---|---|

| AOV impact | Temporary 10–15% lift | Sustainable 20–25% lift |

| Gross margin | Drops by 15–20 points | Largely protected |

| Repeat purchase rate | ~27% | 45% |

| Brand perception | Price-driven | Premium, customer-centric |

| Checkout abandonment | Remains high | Drops significantly |

Discounts push volume. EMI builds value.

How Enterprise D2C Brands Are Using EMI to Scale AOV

Encouraging Customers to “Trade Up”

EMI enables product upgrading, not just conversion. Good–Better–Best pricing works better with EMI. When customers see ₹30,000, ₹45,000, and ₹60,000 options alongside monthly EMI amounts, the difference feels smaller. Customers naturally move to higher tiers. Bundles convert better with EMI visibility.

A ₹50,000 bundle feels expensive upfront.

“₹4,166/month for the complete bundle” feels achievable.

Brands using EMI with bundles see double-digit AOV growth.

Expanding Reach Without Lowering Prices

EMI helps brands grow without sacrificing positioning. Customers outside metros are comfortable with monthly commitments but hesitant about large upfront spends. EMI bridges this gap.

Premium pricing stays intact Instead of lowering price, EMI lowers friction. Brands reach new segments while keeping list prices unchanged. This is especially important as India’s aspirational middle class grows rapidly.

Increasing Checkout Confidence at High Cart Values

The final payment step is where most drop-offs happen. EMI visibility at PDP reduces hesitation

Showing “Starting at ₹X/month” on product pages prepares customers early. It removes sticker shock before checkout. EMI at checkout creates choice and control Customers feel in control when they can choose tenure and payment method. This alone reduces abandonment by 10–15%. EMI does not just help customers pay. It helps them decide.

No-Cost EMI: When It Works and When It Doesn’t

Understanding the True Cost of No-Cost EMI

“No-cost EMI” is never truly free. The interest cost is absorbed by:

- The merchant (most common)

- The bank or NBFC

- Price adjustments or discounts

There may also be processing fees and GST. For enterprise brands, this cost must be measured and controlled.

Smart Ways Enterprises Structure No-Cost EMI

- Apply it selectively on hero SKUs or high-margin bundles

- Control offers by card type, bank, and tenure

- Use no-cost EMI as a campaign lever, not a default option

Festive periods, launches, and limited windows deliver better ROI.

Common Mistakes Enterprises Make

- Offering no-cost EMI on all products

- Measuring success only by order volume

- Ignoring reconciliation and settlement complexity

No-cost EMI without tracking CAC, repeat rate, and margin impact quickly becomes unprofitable.

What Makes EMI Work at Enterprise Scale

Why EMI Setup Matters More Than EMI Availability

Enterprise brands need multi-bank, multi-tenure coverage.

If one bank fails, traffic must reroute instantly. Failure recovery alone can save 8–12% of lost transactions.

The Importance of Seamless Ecommerce EMI Integration

- Plug-and-play integrations work well for speed and lower risk

- API-led integrations work better for scale, routing control, and higher success rates

Many enterprises now use hybrid models. Checkout speed also matters. EMI calculations must load in milliseconds, not seconds.

Omni-Channel Consistency

Customers move between website, app, WhatsApp, and offline stores. EMI terms must stay consistent everywhere. Finance teams also need unified dashboards for:

- EMI AOV

- Success rates

- Settlements

- Reconciliation

Without this, scale breaks operations.

What Enterprise Brands Should Look for in an EMI Payment Partner

Enterprise-Grade EMI Capabilities

- High uptime during peak traffic

- Custom EMI logic by product and segment

- Deep analytics and reporting

Beyond Checkout: Operational and Finance Readiness

- Automated reconciliation

- Clear settlement timelines

- RBI-compliant lending framework

- Scalability across channels

Conclusion

Discount-led growth has reached its limit. For enterprise D2C brands in India, EMI is no longer optional. It protects margins, increases AOV, improves repeat purchases, and preserves brand value. EMI is not a payment feature. It is a revenue strategy.

Brands that invest in EMI infrastructure today will scale sustainably tomorrow, without racing to the bottom on price.

FAQs

1. Can EMI work across online and offline channels?

Yes, with consistent setup across web, mobile, assisted sales, and physical stores.

2. What is EMI for D2C ecommerce in India?

EMI allows customers to split high-value purchases into monthly instalments, improving affordability and conversions.

3. How does EMI help increase AOV?

EMI reduces price shock, encourages customers to upgrade, and boosts bundle sales.

4. Is EMI better than discounts?

Yes. EMI protects margins while increasing AOV and repeat purchases.

5. How complex is ecommerce EMI integration?

Multi-bank support, tenure configuration, and reconciliation workflows are required. API-led or hybrid setups work best.

6. What is a no-cost EMI payment gateway?

It allows instalments without visible interest; the cost is absorbed by merchant or bank.

7. When should D2C brands offer no-cost EMI?

High-margin products, flagship launches, and limited campaigns.

8. Does EMI reduce cart abandonment?

Yes, by making high-ticket purchases feel affordable through monthly payments.