Introduction

UPI has become the backbone of India’s digital economy. In June 2025 alone, it processed 18.39 billion transactions worth ₹24.03 lakh crore, with an average of 628 million daily payments (1). India now accounts for 48.5% of all real-time global transactions.

But this growth brings pressure. Legacy switches, many built more than a decade ago, were designed for batch processing, cards, and low volumes. They are buckling under the load of modern UPI payments. Enterprises need faster, smarter, and more resilient infrastructure, and that’s where the UPI Switch comes in.

Understanding Payment Switches

Payment switches are the backbone of digital transactions. Here we break down the difference between traditional legacy switches and modern UPI Switches.

What is a Legacy Payment Switch?

- Built for cards and NEFT/RTGS, not instant UPI volumes.

- Handles transactions in batches, often with delays.

- High CAPEX/OPEX due to heavy on-premise infrastructure and maintenance.

- Manual reconciliation is prone to errors and delays.

- Slow innovation, adding new features can take months.

What is a UPI Switch?

- Built for real-time, API first payments.

- Cloud native and scalable with a multi-tenant architecture.

- Smart routing with automatic failover to reduce failures.

- Sub 100ms processing time for instant confirmations.

- Auto reconciliation to eliminate manual matching.

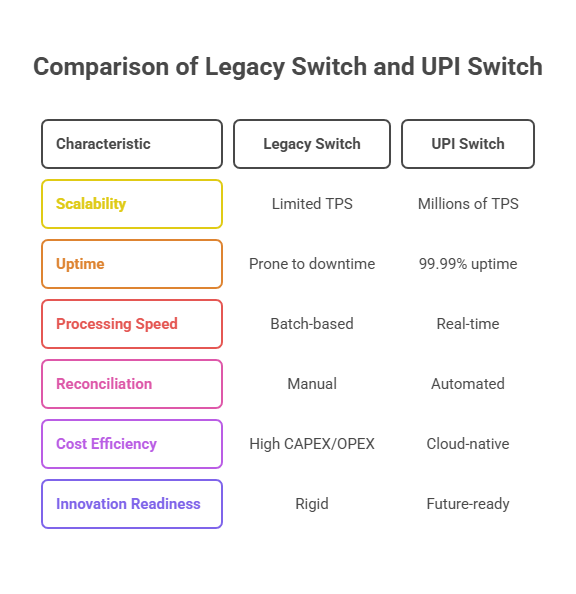

Key Differences Between UPI Switch and Legacy Switches

Payment switches are the backbone of digital transactions. Here we break down the difference between traditional legacy switches and modern UPI Switches.

Scalability & Performance

- Legacy: Limited TPS, frequent failures under peak load.

- UPI Switch: Handles millions of TPS, designed for 1B+ daily transactions.

Reliability & Uptime

- Legacy: Outages during surges, success rates drop.

- UPI Switch: 99.99% uptime, AI-powered routing, and failover management.

Cost & Efficiency

- Legacy: High hardware and manpower costs.

- UPI Switch: Cloud deployments, shared infra, up to 50% TCO reduction.

Compliance & Security

- Legacy: Manual audits, weaker monitoring.

- UPI Switch: Automated compliance with PCI DSS, RBI/NPCI, and real-time audit trails.

Innovation Readiness

- Legacy: Rigid, not future-ready.

- UPI Switch: Supports UPI Lite, AutoPay, Credit on UPI, CBDC, cross-border corridors in 12+ countries.

Why Enterprises Are Making the Shift

Banks, large merchants, and fintechs are moving to UPI Switches to meet rising payment volumes and deliver better reliability.Banks

- Must handle massive volumes with low latency.

- RBI/NPCI compliance pressure.

- Customers expect 24/7 reliability.

Large Merchants

- Airlines, NBFCs, e-commerce demand:

- High success rates.

- Instant reconciliation and faster settlements.

- Ability to handle festive/flash sale spikes.

Fintechs & PSPs

- Need infra differentiation: speed, uptime, easy merchant onboarding.

- Switch helps them compete with bigger players by offering enterprise-grade infrastructure.

Case for UPI Switch – The Enterprise ROI

Beyond technology, UPI Switches deliver measurable business impact: higher success rates, faster settlements, and lower costs.

Improved Success Rates

- 4–5% higher success rates → direct revenue impact.

- For a business processing 1M transactions/month, that means ₹40 lakh+ recovered revenue.

Faster Settlements

Moves from T+2/T+3 cycles to T+0/T+1.

- Improves cash flow and reduces credit risk.

Lower Operational Costs

- Cloud infra = reduced CAPEX.

- Automation cuts manual reconciliation and manpower costs.

- Up to 400% ROI reported in modernization cases.

Challenges in Migration from Legacy to UPI Switch

Moving from a legacy system to a modern UPI Switch isn’t without hurdles—here are the key challenges enterprises must address.

Integration Complexity

- API first systems must align with old bank cores.

- Requires strong testing and data migration planning.

Change Management

- Staff training is critical.

- Enterprises must update processes and culture to adopt new tech.

Compliance Transition

- Migration must stay audit-ready for NPCI/RBI.

- Risk management to avoid downtime during switchover.

The Future of Payment Switching in India

As UPI adoption soars, UPI Switches will power innovations like CBDC, cross-border payments, and 1 billion daily transactions.

UPI as the Core Payment Rail

- UPI Switch becomes default infra for banks/PSPs.

- Supports multiple rails on one platform.

Beyond Domestic

- Cross-border corridors already exist in 12 countries.

- CBDC + UPI QR integration coming soon.

Enterprise Advantage

- Early adopters scale faster, gain trust, and reduce costs.

- Position as leaders in digital payments innovation.

Final Thoughts

Legacy switches cannot keep up with India’s speed, scale, and innovation needs. With UPI headed toward 1 billion daily transactions, enterprises must modernize their infrastructure.

UPI Switch is the enterprise backbone for the next decade of payments. Those who move early will win in success rates, efficiency, and customer experience while laggards risk being left behind.

FAQ

What is the UPI Switch?

The UPI Switch is a high-speed transaction engine that routes UPI payments in real time. It ensures faster settlements, smart routing, and higher success rates.

Who is UPI Switch partnered with?

UPI Switch works with banks, payment service providers (PSPs), and fintech companies, enabling them to process high volumes of UPI transactions efficiently.

When was UPI Switch launched?

The UPI Switch model has evolved with NPCI’s upgrades since 2016, but advanced switches built by fintechs and banks gained traction from 2022 onwards to handle massive transaction growth.

What is the NPCI UPI Switch architecture?

The NPCI UPI Switch is designed on a high-availability, API-first, multi-tenant architecture. It supports real-time routing, failover management, settlement, and compliance tracking.

How does a UPI Switch improve success rates?

It uses AI-powered smart routing and automatic retries, ensuring transactions are directed through the most reliable channels, reducing failures.

Why do banks need a UPI Switch in 2025?

With UPI volumes expected to hit 1 billion transactions per day, banks need UPI Switches to guarantee uptime, compliance, and seamless customer experiences.

Is UPI Switch different from NPCI’s core UPI system?

Yes. NPCI operates the UPI network, while switches built by banks or fintechs optimize routing, reliability, and reporting for their own ecosystem.

Can UPI Switch support cross-border payments?

Yes. UPI Switches can process multi-currency transactions, helping UPI expand globally in countries like the UAE, Singapore, and Nepal.

What security features does a UPI Switch offer?

Modern UPI Switches include encryption, tokenization, AI fraud detection, and biometrics to safeguard high-volume digital transactions.