Quick Answer

A payment aggregator is a regulated service provider that enables businesses to accept digital payments by collecting funds on their behalf and settling them to the merchant’s account.

It allows merchants to accept UPI, cards, net banking, wallets, and other payment methods without signing individual agreements with each bank or network.

One-Line Definition

A payment aggregator simplifies digital payments by onboarding merchants, processing transactions, and settling funds through a single integrated platform.

What Is a Payment Aggregator?

A payment aggregator (PA) is a fintech service that acts as an intermediary between customers, merchants, and banks.

Instead of requiring businesses to open and manage separate contracts with multiple banks and payment networks, a payment aggregator brings everything together under one system.

The aggregator:

- Onboards merchants

- Enables multiple payment methods

- Applies risk and compliance checks

- Collects payments from customers

- Settles funds to the merchant’s account

In simple terms, the payment aggregator takes responsibility for the entire payment acceptance and settlement process.

How Does a Payment Aggregator Work?

A payment aggregator typically works in the following steps.

Step 1. Customer Makes a Payment

The customer selects a payment option such as UPI, card, net banking, or wallet during checkout.

Step 2. Aggregator Processes the Transaction

The payment aggregator securely captures the transaction details and routes them to the relevant bank or payment network. Fraud and risk checks are applied in real time.

Step 3. Funds Are Settled to the Merchant

Once approved, the aggregator collects the funds and settles them into the merchant’s account, often on the same day or within predefined timelines.

Instead of managing multiple integrations, the merchant integrates once with the payment aggregator and gains access to all major payment modes.

Why Do Businesses Use a Payment Aggregator?

Businesses use payment aggregators to simplify operations and scale faster.

Key reasons include:

- Easy onboarding: One integration and fewer bank contracts

- More ways to pay: Support for UPI, cards, net banking, wallets, EMI, and BNPL

- Faster settlements: Predictable payout cycles and quicker access to funds

- Built-in risk and compliance: Security, monitoring, and regulatory checks handled by the aggregator

- Scales with growth: Handles volume spikes, new payment rails, and expansion across channels

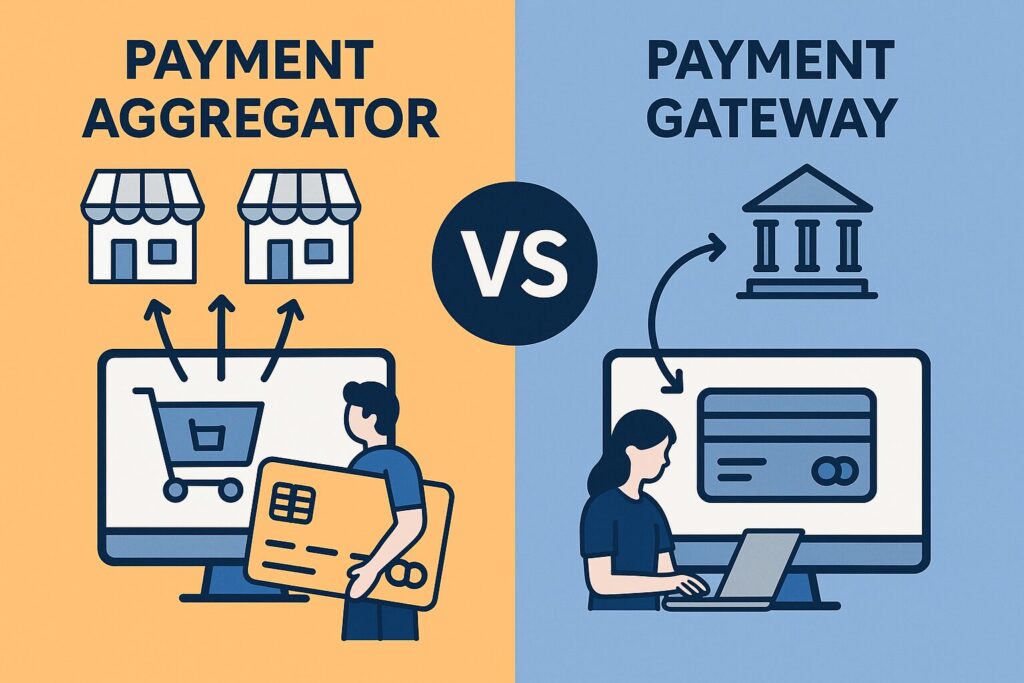

Payment Aggregator vs Payment Gateway

Although often used together, payment aggregators and payment gateways are not the same.

Key Difference Explained Simply

- Payment Gateway: The technology that securely transmits payment data between the customer, merchant, and bank

- Payment Aggregator: The service provider that onboards merchants, collects payments on their behalf, and settles funds to them, often bundling a payment gateway as part of the offering

Think of the gateway as the bridge for payment data, while the aggregator is the bridge plus the operator managing merchant onboarding, money flow, and settlements.

Why Do Payment Aggregators Matter to Consumers?

For consumers, payment aggregators improve the checkout experience.

They provide:

- Choice to pay using UPI, cards, wallets, EMI, or net banking

- Speed with faster and smoother transactions

- Security through encryption and authentication

- Reliability with clear transaction status and confirmations

Most consumers may not see the aggregator, but they benefit from its role in every successful payment.

Why Payment Aggregators Matter in Today’s Digital Economy

If you have ever booked a flight, paid a utility bill, or shopped online, you have likely used a payment aggregator without realizing it.

As digital payments grow, businesses need:

- Simpler onboarding

- Fewer dependencies on individual banks

- Unified settlement and reporting

Payment aggregators provide the infrastructure that makes modern digital commerce possible at scale.

Frequently Asked Questions About Payment Aggregators

What is a payment aggregator in simple terms?

A payment aggregator is a service that allows businesses to accept multiple digital payment methods and receive funds without directly integrating with every bank or payment network.

How is a payment aggregator different from a payment gateway?

A payment gateway transmits payment data securely, while a payment aggregator manages merchant onboarding, payment collection, and settlement, often using a gateway internally.

Who needs a payment aggregator?

E-commerce businesses, marketplaces, startups, enterprises, and any merchant handling digital payments across multiple modes benefit from using a payment aggregator.

Are payment aggregators regulated?

Yes. In many markets, including India, payment aggregators operate under regulatory guidelines and compliance frameworks set by financial authorities.

Final Thoughts

Payments do not just move money. They enable trust.

A payment aggregator plays a critical role in simplifying how businesses accept payments and how customers choose to pay. By handling onboarding, processing, and settlements under one platform, payment aggregators remove friction from digital commerce.

As payment volumes grow and customer expectations rise, payment aggregators are no longer optional infrastructure. They are a foundation for scalable, reliable, and secure digital payments.